Malta Stock Exchange Achieves Strong Growth Over the Past Decade

Malta Stock Exchange Achieves Strong Growth Over the Past Decade

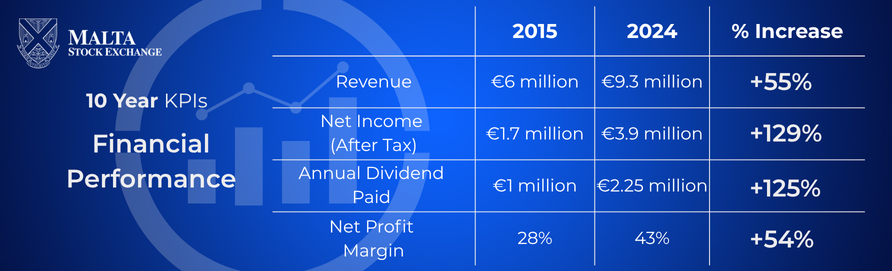

The Malta Stock Exchange (MSE) has reported an impressive financial performance over the past 10 years, with marked improvements in all key performance indicators between 2015 and 2024. The latest data underscores the Exchange’s robust growth trajectory, sound financial management, and strategic progress.

Revenue Growth

One of the most significant highlights is the substantial increase in revenue. In 2015, the MSE generated €6 million in revenue, which has surged to €9.3 million by 2024. This reflects a 55% increase over the decade, signaling increased activity and demand across MSE’s services and listings.

Net Income More Than Doubles

The MSE’s net income (after tax) experienced exceptional growth, climbing from €1.7 million in 2015 to €3.9 million in 2024. This represents a remarkable 129% increase, showcasing the Exchange's improved profitability and operational efficiency.

Increased Shareholder Returns

In line with its enhanced financial performance, the MSE also significantly raised its annual dividend payouts. The Exchange paid €1 million in dividends in 2015, which increased to €2.25 million in 2024 — a 125% rise, reflecting strong returns to shareholders and a healthy financial position.

Stronger Profitability

Net profit margin, a key measure of profitability, improved from 28% in 2015 to 43% in 2024. This notable 15-percentage-point gain highlights the Exchange’s effective cost control and ability to convert revenue into actual profit at a higher rate.

Conclusion

The Malta Stock Exchange's performance over the last decade is a testament to its resilience, strategic foresight, and strong governance. With solid growth across revenue, profits, dividends, and margins, the Exchange is well-positioned to continue its upward momentum, reinforcing its role as a cornerstone of Malta’s financial sector.